Step-by-Step Guide To Calculating IRR Using A Financial Calculator

How to Use a Financial Calculator to Calculate IRR

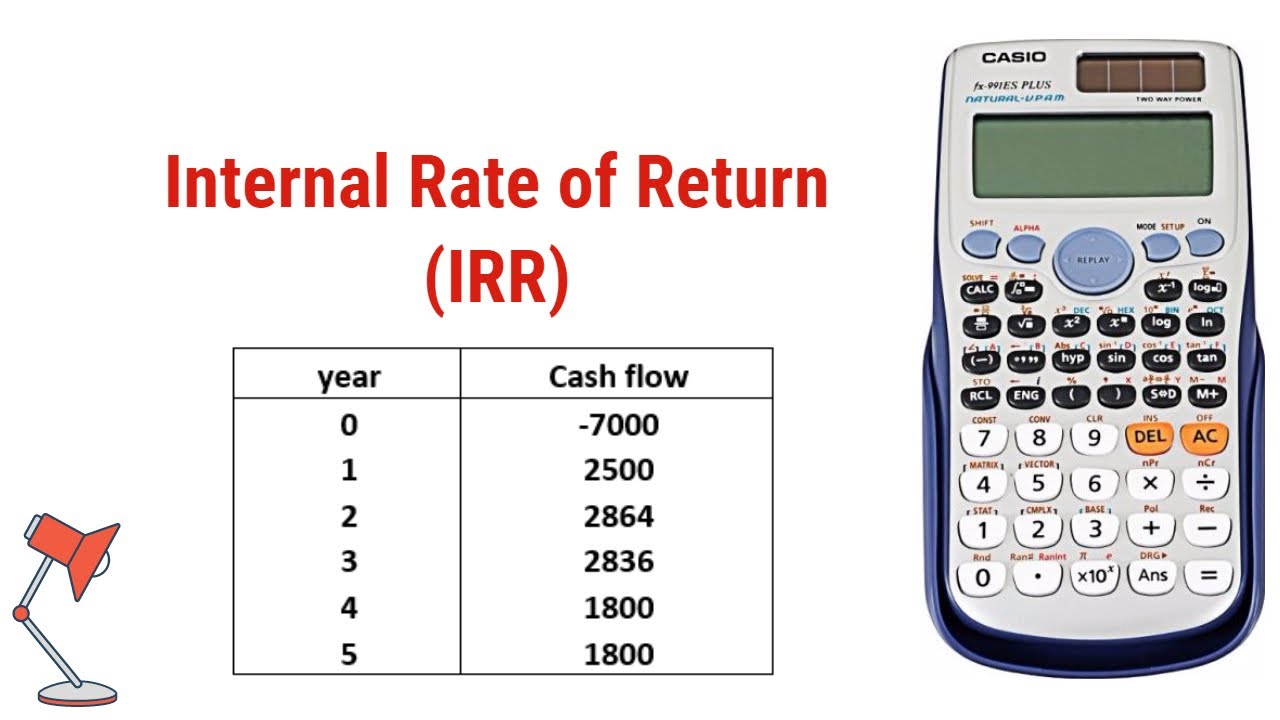

Calculating the Internal Rate of Return (IRR) is a crucial step in evaluating the profitability of an investment. A financial calculator can simplify this process, providing quick and accurate results. Here's a step-by-step guide on how to use a financial calculator to calculate IRR:

1. Enter the cash flows: Input the series of cash flows associated with the investment, including both positive (inflows) and negative (outflows) values.

2. Set the financial calculator to IRR mode: Most financial calculators have a dedicated IRR function. Locate and select the IRR button.

3. Solve for IRR: The calculator will display the IRR as a percentage. This value represents the annualized rate of return that makes the net present value (NPV) of the investment equal to zero.

4. Interpret the result: The IRR indicates the potential profitability of the investment. A higher IRR generally implies a more attractive investment opportunity.

FAQs on How to Use a Financial Calculator to Calculate IRR

This section addresses frequently asked questions (FAQs) about calculating the Internal Rate of Return (IRR) using a financial calculator.

Question 1: What is the significance of IRR in investment evaluation?

Answer: IRR is a crucial metric that indicates the potential profitability of an investment. It represents the annualized rate of return that equates the net present value (NPV) of the investment to zero. A higher IRR generally signifies a more attractive investment opportunity.

Question 2: How do I handle irregular cash flows when calculating IRR using a financial calculator?

Answer: Financial calculators typically have a dedicated IRR function that can accommodate irregular cash flows. Ensure that you enter the cash flows in chronological order and input zero for any periods without cash flow activity.

Summary: Calculating IRR using a financial calculator is a valuable skill for evaluating the profitability of investments. By understanding the significance of IRR and the steps involved in its calculation, investors can make informed decisions about their financial ventures.

Conclusion

Calculating the Internal Rate of Return (IRR) using a financial calculator is a fundamental skill for evaluating the profitability of investments. This article has provided a comprehensive guide on how to use a financial calculator to determine IRR, emphasizing its significance in investment decision-making.

By understanding the steps involved in IRR calculation and interpreting the results, investors can assess the potential return on their investments and make informed choices about allocating their capital. Financial calculators remain invaluable tools for financial professionals and investors alike, simplifying complex calculations and empowering informed decision-making.

Get To The Heart Of Ode On A Grecian Urn: Unraveling Its Profound Meaning

Discover The Perfect Time: Understanding Half Past One

Explore Stoic Beliefs: A Guide To Wisdom, Resilience, And Fulfillment