The Ultimate Tool For Accurate IRR Calculations

Thinking about making an investment? Calculating the IRR (Internal Rate of Return) is crucial to ensure profitability. An IRR financial calculator simplifies this process, streamlining your investment decisions.

An IRR financial calculator is a tool designed to determine the IRR of an investment. IRR represents the annualized rate of return that an investment is expected to generate over its lifetime, considering both positive and negative cash flows. It essentially measures the profitability and attractiveness of an investment.

Understanding IRR is vital for making informed investment choices. A positive IRR indicates that the investment is expected to generate returns higher than the cost of capital, making it a potentially lucrative opportunity. Conversely, a negative IRR suggests that the investment is likely to yield lower returns than the cost of capital, indicating a less favorable option.

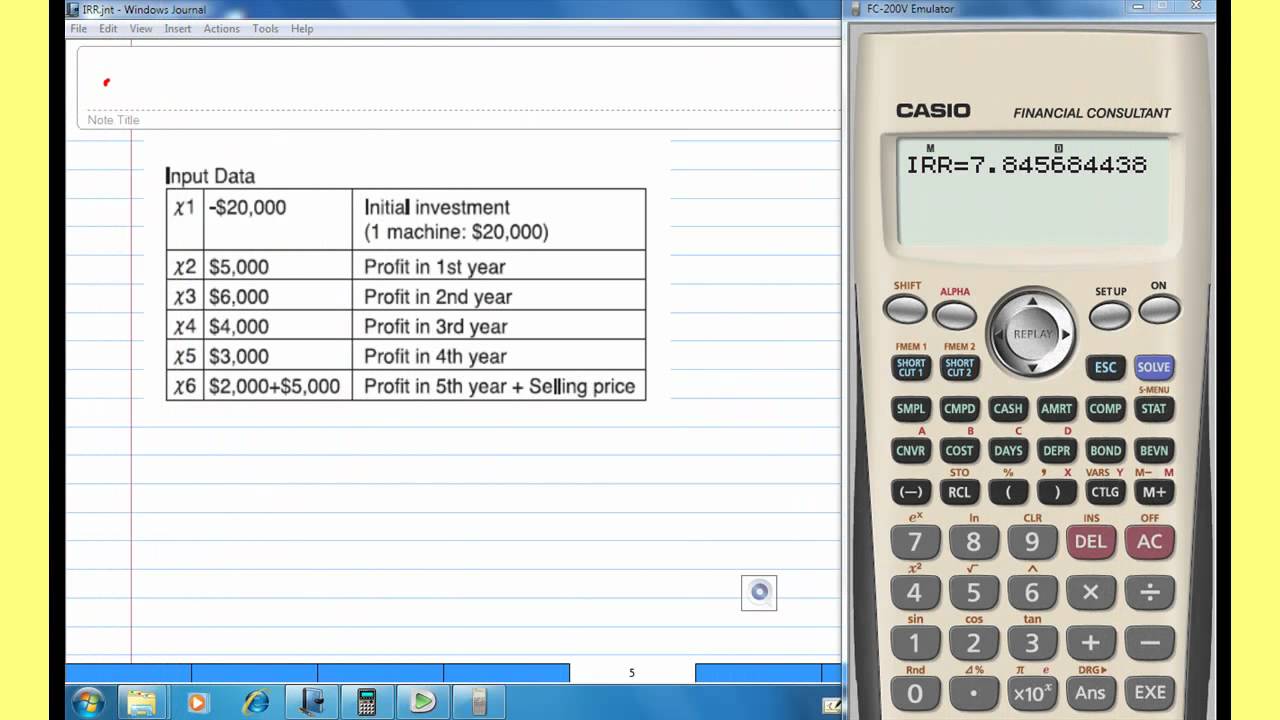

IRR financial calculators simplify the calculation process, making it accessible to investors of all levels. These calculators typically require you to input the initial investment amount, cash flows (both positive and negative) over the investment period, and the estimated holding period. The calculator then uses predefined formulas to compute the IRR.

The benefits of using an IRR financial calculator are numerous. It saves time and effort by automating the calculation process, which can be complex and time-consuming when done manually. Additionally, it enhances accuracy by minimizing the risk of errors that may occur during manual calculations.

Furthermore, IRR financial calculators provide consistency in calculations, ensuring that the IRR is determined using the same methodology across different investments. This consistency allows for easier comparison of investment options and facilitates informed decision-making.

Overall, an IRR financial calculator is an indispensable tool for investors seeking to evaluate the potential profitability of an investment. Its ease of use, accuracy, and consistency make it an essential resource for making sound investment decisions.

Frequently Asked Questions about IRR Financial Calculator

This section addresses frequently asked questions about IRR financial calculators to provide clarity and enhance understanding.

Question 1: What is the significance of using an IRR financial calculator?

An IRR financial calculator is a valuable tool that simplifies the calculation of the Internal Rate of Return (IRR) for an investment. IRR represents the annualized rate of return that an investment is expected to generate over its lifetime, considering both positive and negative cash flows. Understanding IRR is crucial for making informed investment decisions as it indicates the potential profitability and attractiveness of an investment.

Question 2: How can an IRR financial calculator benefit investors?

IRR financial calculators offer several benefits to investors. They save time and effort by automating the calculation process, which can be complex and time-consuming when done manually. Additionally, they enhance accuracy by minimizing the risk of errors that may occur during manual calculations. Furthermore, IRR financial calculators provide consistency in calculations, ensuring that the IRR is determined using the same methodology across different investments. This consistency allows for easier comparison of investment options and facilitates informed decision-making.

In summary, IRR financial calculators are essential tools for investors seeking to evaluate the potential profitability of an investment. Their ease of use, accuracy, and consistency make them an invaluable resource for making sound investment decisions.

Conclusion

IRR financial calculators have revolutionized the way investors evaluate the profitability of investments. Their ease of use, accuracy, and consistency make them an indispensable tool for making informed investment decisions. By leveraging the power of IRR financial calculators, investors can streamline their investment analysis process, minimize risks, and maximize returns.

As the investment landscape continues to evolve, IRR financial calculators will undoubtedly remain a cornerstone of financial decision-making. Their ability to simplify complex calculations and provide valuable insights into investment potential will continue to empower investors and contribute to the success of their financial endeavors.

The Ultimate Ratchet Guide: Types, Features, And Uses

The Ultimate Guide To Sister Act 2: Meet The Stellar Cast

Discover The Characteristics Of A Mini Blizzard